A “green” memorandum: hitting Guaranteed Buyer’s debts with declarations

How to implement its provisions, given the current state of the Ukrainian economy?

No matter what people are talking about, eventually the talk always comes down to money. That was what happened in the case of the memorandum between the Government of Ukraine and investors in renewable energy, too. And while everything is more or less clear as regards the restructuring of the “green” tariff, the amount of debt owed by Guaranteed Buyer SE to electricity producers raises doubts as regards the possibility to settle it in a reasonable time. Ukrainian Energy tried to sort out the matters concerning implementation of this memorandum and the problems surrounding it.

Pursuant to the memorandum between the Government and “green” investors, MPs were going to consider the draft law lowering the “green” tariff at the extraordinary session of the parliament on Tuesday, 14 July. In the end, the parliament voted to shorten the deadline for submission of amendments before the second reading of the draft law. 228 people’s deputies voted for it. It gives the chance that the law will be passed before the parliament goes into summer recess.

Ukrainian Energy reported that earlier, the Verkhovna Rada adopted as the basis the draft law amending certain laws of Ukraine to improve the conditions of supporting electricity generation from alternative energy sources. MPs adopted the draft law 3658 in first reading. This draft law was initiated by the Energy Ministry, and the President designated it as urgent; on their part, the Verkhovna Rada’s specialized committee also supported this document.

It is worth reminding that on 10 June, the European-Ukrainian Energy Agency (EUEA) and the Ukrainian Wind Energy Association (UWEA) signed a memorandum. The purpose of this document is, in particular, to restructure the debt owed by Guaranteed Buyer state enterprise to “green” power generating companies.

What has been agreed upon?

- Lowering by 15% the "green" tariff for solar power plants built in 2015-2019

- Lowering by 7.5% the "green" tariff for wind power plants built in 2015-2019

- Reducing the pre-PPA terms for solar power plants by 31 July 2020

- Lowering by 2.5% the "green" tariff for wind and solar power plants commissioned after 01 January 2020

- Guaranteeing full payments currently due to renewable power generating companies by Guaranteed Buyer

- Approving a schedule of settling overdue debt to renewable electricity producers

Not to everyone’s taste

In the opinion of Acting Minister Olha Buslavets, provisions of the memorandum represent a compromise and accommodate interests of consumers, investors, and the state on the whole.

Still, not all investors believe that the provisions of this memorandum are a compromise.

Thus, in particular, international financial organizations which provided low-interest financing and loan guarantees, and afterwards some 120 investors more, wrote a letter to the President and the Energy Ministry, urging them to extend the restructured “green” tariff. International creditors and foreign investors maintain that lawsuits in international courts could be possible otherwise, so to avoid them, the “green” tariff should be extended for at least two years. The reasons for lawsuits could be “significant lowering of the reduced-rate tariff”, debt restructuring under contracts and the stake in joint-stock capital, the letter says.

This letter was signed by international financial organizations-creditors: Dutch development bank FMO, Norwegian Export Credit Guarantee Agency (GIEK), and Nordic Environment Finance Corporation (NEFCO). These organizations urge a broader consensus when considering the draft law 3658. They believe that without it, many renewable energy projects would face nonpayment of debt to one’s own creditors.

In the opinion of the authors of this address, the proposed amendments to legislative and regulatory acts concerning the “green” tariff, imbalances and so on must be approved by all representatives of the energy sector. It means over 800 power generating enterprises and over 7 GW of installed capacity.

This letter was also addressed to Guaranteed Buyer SE, the NEURC, Ukrenergo, Andrii Gerus as the Chairman of the Verkhovna Rada Committee for Energy, Housing and Utilities, and David Arakhamiia as the leader of Servant of the People parliamentary faction.

Besides the creditors and investors, foreign governments did not remain on the sidelines, either. Thus, U.S. Representatives Mike Quigley and Marcy Kaptur urged President Volodymyr Zelensky in their open letter to find a consensus between the restructuring of the “green” tariff and preservation of favorable conditions for foreign direct investments. They reminded the President about over US 2 billion in sectoral foreign investments, the use of American private capital, and the delivery of equipment (wind turbines) manufactured by General Electric. In addition, the U.S. Representatives mentioned direct economic interest in the ease of doing business in the energy sector: the United States is the largest shareholder in EBRD, which is the leading foreign creditor of the renewable energy sector in Ukraine with almost EUR 600 million in disbursed financing.

From the very beginning, there were those dissatisfied with the memorandum, especially among solar power generating companies. However, Mats Lundin, Chairman of the EUEA Board, said that the memorandum is not the point of destination but rather the starting point to make sure that personnel of power plants are paid their wages and investors continue to build and operate power generating facilities and serve the communities.

Time to gather stones

The memorandum in itself is only a declaration of intents. What’s much more important is what will be written in the law and whether all stakeholders will consider it fair. And secondly, whether investors will want to accept the new rules as firm, if the government has already changed them. But what is important even more is the payment of debt by Guaranteed Buyer.

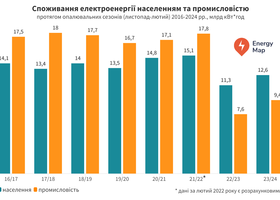

As of the beginning of June, the debt owed by Guaranteed Buyer to green power generating companies amounted to UAH 17.57 billion. Since the year’s beginning, Guaranteed Buyer bought 5.12 million MWh of “green” electricity while paying only UAH 6.5 billion under the “green” tariff, which is 27% of the amount due.

The main reason for the overdue amount owed by Guaranteed Buyer to renewable power producers is Ukrenergo NPC’s debt to the state enterprise for the increasing share of electricity production from alternative sources. This service is the legislatively adopted source of payments under the “green” tariff. According to information by Guaranteed Buyer, the total amount owed by Ukrenergo as of the beginning of July has reached almost UAH 20 billion. Without forthcoming payment from the TSO, Guaranteed Buyer cannot pay “green” power generating companies.

The TSO is also owed money for electricity transmission, but the figures are incomparable and even if all debtors settle their debt to Ukrenergo, it would not have solved the problem of nonpayment to Guaranteed Buyer. The problem is more global and systemic.

As a matter of fact, the structure of Ukrenergo’s electricity transmission tariff lacks funds in principle to cover special obligations placed upon it. Thus, for the entire year 2020 the company’s tariff envisages only UAH 8.6 billion for payments to Guaranteed Buyer, whereas according to the TSO’s estimates, only the amount currently due to it has exceeded UAH 16 billion as of June.

The situation becomes even more complicated due to the fact that this debt includes not only the difference between the buy and sell price of “green” electricity but also the compensation of Guaranteed Buyer’s costs of selling electricity to universal service providers (USPs) for household needs, which wasn’t envisaged in Ukrenergo’s tariff, either, the company emphasizes.

Where to get money

At the same time, Ukrenergo advocates capping of the raise of tariff for its services, realizing that the rise of tariff may result in more unpaid bills by consumers: industrial consumers and certain MPs have already voiced their opposition, and Oleksandr Dubinskyi has even begun gathering signatures for recognition of the current “green” tariff rate unconstitutional. Ukrenergo believes that proceeds from interconnector distribution auctions could be used as an additional source for payment of debt to Guaranteed Buyer, if that could be legislatively adopted (by passing the draft law on certification of Ukrenergo). It would allow to pay additional UAH 1.4 billion to Guaranteed Buyer. Another possible source is the NEURC’s proposal to introduce excise tax of at least 3.2% on electricity produced from renewable sources. In the end, after a series of discussions, the regulatory agency approved on 11 July 2020 a new tariff at the rate of 240.23 UAH per MWh instead of the initially proposed 596.48 UAH per MWh (a 1.5-times tariff raise instead of fourfold).

In addition, Ukrnergo urges to change the PSO mechanism for households by having Energoatom switch to direct contracts with USPs and freeing the remaining electricity production output of nuclear power plants for sale in the free market. Ukrenergo also proposes to bring external financing to cover debts in the electricity market accumulated during the first half of this year.

Therefore, the sources of financing proposed by the “biggest debtor” include:

- Proceeds from interconnector distribution auctions

- External financing

- Moneys freed by changing the PSO system

In the opinion of ExPro Consulting CEO Hennadii Kobal, sources of payments could include subventions from the state budget, issuance of domestic government bonds and “green” bonds. And at this point, a volitional political decision must be made, for otherwise, an arbitration will become unavoidable and the government will have to pay anyway, but in that case, it will lose reputation among investors and incur additional legal expenses.

Does it make sense to look for the guilty?

Was it possible to estimate the accumulation of such a debt beforehand? They say that nobody could expect such a powerful “green boom”, and even more so, adjusted for the realities of the “new electricity market”. We all remember the year 2019, when the rest of those wanting to “backdoor” their way to the “green” tariff were hurrying to get the government support for renewable energy. “Besides financial stimulation per se, the National Action Plan for Renewable Energy for the period until 2020, which sets forth indicative goals for different types of renewable energy sources, and therefore, investment benchmarks, played not the least role for investors,” energy expert Yaroslav Melekh says. “Thus, as of 01.05.2020, the installed capacity of active wind power plants was 53% of the planned target by the end of 2020; the same figure was 244% for solar power plants, 19.2% for biomass- and biogas-fired power plants and 77% for small hydroelectric power plants. According to the National Plan, the aggregate capacity of the aforementioned types of renewable energy sources should have been 5680 MW, but instead, re-stimulation by the “green” tariff produced a situation in which 5600 MW of generating capacity was built in the solar power industry alone. This situation became a consequence of different attractiveness of tariffs for different types of renewable energy sources, ease of building and typicality of these projects,” the expert believes. “The government’s inability to foresee and adjust the sector’s development dynamics without radically changing the rules of the game also was not the least important factor.”

The realities of Ukrainian public administration raise doubts whether anybody gave any thought at all from the very beginning as to what consequences of such a generous support for renewable energy will be for the national economy and the country’s integrated power system. Nature abhors a vacuum – if a profitable niche occurs, an investor will definitely come in there. If he wasn’t scammed before, of course. And at this point, we’re getting back to the consequences of defaulting on obligations and possible arbitrations.

Who benefits from that?

There is a belief that some persons are interested in bankrupting renewable energy enterprises, which then could be bought for peanuts. Perhaps it looks like a conspiracy theory. However, Ukraine has already had a similar experience, when during the first wave of privatization enterprises were artificially bankrupted and then sold at auctions, underpriced. It did not contradict the letter of law, and certain businessmen who had connections with the right people and who were daring enough took advantage of that. If intentions like that are nursed this time around, one should think about how to prevent the repetition of this scenario in the “green” energy sector, even if everything formally goes according to rules.

“The first signal was the proposed provisions of the draft law 3658 raising the maximum share of the auction winner – ultimate beneficial owner from 25% to 35% of the annual support quota,” energy expert Yaroslav Melekh explains. “And even though direct interrelation is presently not visible, one should not forget about the last year’s decisions of AMCU, which allowed Rinat Akhmetov to buy another two oblenergo companies and thus exceed the 35% threshold in the electricity supply market, which is a structural sign of market monopoly. Are similar scenarios possible in the renewable energy market? Time will tell.”

As the situation around the “green” legislation reveals, before setting rules one should thoroughly calculate their consequences. After all, regardless of whether a debt collapse was caused by malicious intent, or by gross negligence, unprofessionalism and short-sightedness of parliamentarians and civil servants, or for objectively unpredictable reasons, financial consequences will still be the same. And as always, it will be consumer who will have to pay for everything.

Olesia Natkha for Ukrainian Energy