Electricity market. Two wrongs does not make a right

Why proposed amendments to the Electricity Market Law is not the right cure for Ukrainian power market

When Ukrainian Parliament adopted the Electricity Market Law back in April 2017 it was largely welcomed by the international experts. Despite all minor flaws, the Law more or less copied the Third Package approach, promising free competition and departure from the then existing “single buyer” model. The electricity market reform was to be carried out quickly (too quickly, many argued). However, Regulator, Government and Parliament did its homework and by the end of 2018, the regulatory framework necessary for a liberal market to exist was in place. And indeed, as of 1 January 2019, a competitive retail market started to function, although in a limited form and only for a selected group of consumers. The price at which household and SME segments were supplied was regulated and since the wholesale market prices were pre-set by the Regulator until end June, there was no real competition among suppliers. Price hikes, if any, were very limited. One of the most visible effect of the “free” retail market existing during the first half of 2019 was gradual accumulation of debt of Ukrinterenergo, the state owned company designated as the supplier of last resort (in June the debt was around 40 mil EUR). All in all, there was a general belief that the real change will come with the dismantling of the “single buyer” model and wholesale market opening on 1 July. And with the D-day approaching, the tendencies to limit and control the free market intensified.

In the course of May and June, Government added to the already existing limitations. Price caps were introduced for electricity sold at the day-ahead and intraday markets (while the requirement to sell at least 10% of the generated electricity at DAM/IDM remained in place). Similar price caps were applied to the balancing market transactions. More importantly, Government introduced requirement for state-owned generating companies to sell nearly all production exclusively via a special trading platform (where the only purchaser is another state owned “Guaranteed Buyer” company, TSO and DSOs) for a pre-established maximum price. As a result of the Cabinet of Ministers’ Public Service Obligation Act, nearly all electricity produced by Energoatom, the largest state-owned generation company and 35% of electricity generated by Ukrhydroenergo, never make it to the free market. Jointly this number represents around 55% of total Ukrainian electricity production. Effectively, majority of the electricity available for purchase at the free market is electricity produced in thermal power plants at higher costs than nuclear and hydro. These plants are predominantly owned by the DTEK group. In 2017, the total output of DTEK was around 36,5 TWh (out of total 155 TWh produced).

The joint effect of all price caps and PSOs is an emergence of two kind of co-existing markets; one “single buyer” market in which the state owned Guaranteed Buyer company purchases Energoatom and Ukrhydroenergo production and uses it for covering household consumption, grid operators’ technical losses and subsidies for RES production and one free market where large/industrial consumers purchase their electricity.

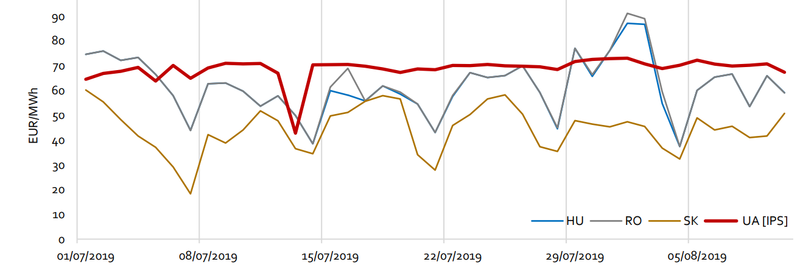

Such market structure is not optimal and fair. For several reasons. First of all, there is no obvious rationale for why only certain producers should bear the costs for services in general interest. From this point of view, it is doubtful if the current arrangement would stand the proportionality test. Secondly, as has been noted above, since the thermal power plants are setting the marginal price at the free market, end-consumers end up paying more than they normally would under a free and functioning merit order. And indeed, wholesale electricity prices in Ukraine after the market opening are higher than in the neighbouring Central European countries, with Poland being an exception. At Ukrainian Energy Exchange, the platform through which state-owned companies must obligatory sell their production, the BASE product was sold for ca. 61 EUR/MWh and PEAK for ca. 68 EUR/MWh on 27.09.2019. The same day, the average price at the day-ahead market was ca. 74 EUR/MWh for the Burshtyn island area and ca. 63 EUR/MWh for the rest of Ukraine. In the meanwhile, BASE in neighbouring Slovakia was sold on 27.09.2019 for 52,27 EUR/MWh and PEAK for 61,99 EUR/MWh. Price at coupled (4M MC) day-ahead market was around 60 EUR/MWh.

Daily average DAM peak prices in Ukraine and neighbouring EU countries

Source: Lowcarbon Ukraine

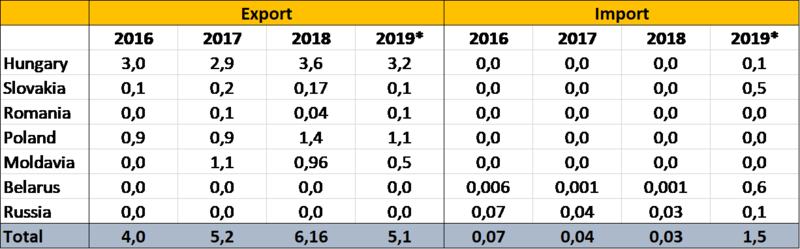

One way for alleviating the problem of high commodity prices in Ukraine is increasing import from countries with less expensive electricity. As of July 2019 when various administrative barriers for import have been lifted, imports from EU countries have increased significantly. In case of Slovakia, import went up from 0 to 0,15 TWh in July alone and cumulatively, it has reached almost 0,5 TWh by end September. Imports from Slovakia, Hungary and Romania are, however, possible only into the Burshtyn island, a relatively small area that is synchronized with ENTSO-E. Imports are limited by the available transmission capacity and by the consumption volumes within the Burshtyn itself. While the daily transmission capacity is around 1000 MW, Ukrenergo has on average put around 850MW at daily auctions during the first three months since the market launch. Most of the capacity was booked by DTEK/D.Trading.[1] Last winter, the maximum consumption of the Burshtyn island was 1044 MW, in general it is oscillating between 800 MW – 410 MW.[2]

Given the limitations, electricity imports from Belarus, Russia and Moldova should be the most straightforward alternative to EU imports. These countries are connected to the main Ukrainian electricity system (ОЕС УКРАЇНИ) and the cross-border transmission capacity available for imports is substantial (Russia – 1,1 GW, Belarus – 600 MW). Due to political reasons, however, imports from these countries have been on gradual decline since 2014 and in first half of 2019, no electricity was imported from Russia. Situation changed again in July 2019 when especially imports from Belarus took off again. The original version of the Electricity Market Law did not set any limits for imports from Russia and Belarus but all electricity imported from these two countries had to be sold exclusively at the day-ahead or balancing markets. That condition was deleted through a recent amendment to the Law.[3] Consequently, as of 24.09.2019 any company in Ukraine can import electricity from Russia and Belarus freely and re-sell it at any market segment, including at bilateral market. In October, companies that booked cross-border capacity for imports from Russia included D.Trading (199MW), DE Trading (301MW), ERU (250MW), TAS-Energy (249MW) and United Energy (100MW). In total, 0,12 TWh was imported from Russia and 0,21 TWh from Belarus in October, according to Ukrenergo. Available data from November suggest that compared to the previous month, import from Russia has grown three-fold, from 4 GWh to 12 GWh.[4]

Import and export to/from Ukraine, 2016 – 2019 (in TWh)

Source: Ukrenergo (*preliminary results for Jan-Oct 2019)

Resuming of electricity imports from Russia have caused controversy. After all, the two countries are involved in a protracted military conflict, Russia has seized part of Ukrainian territory and in certain parts of the society, anti-Russian sentiments are still strong. Therefore, it is quite understandable that throughout October, politicians have sought to address these emotions. Andriy Gerus, the head of the Parliamentary Energy Committee has proposed introduction of special levy on the electricity import from Russia. On 15 October, as many as four different proposals for amendments to the existing Electricity Market Law were tabled by various MPs. Some (Timoshenko) were calling for absolute banning of import from Russia, others (Gerus) requested reintroduction of obligation to re-sell the imported electricity at DAM, at the same time exempting Belarus from the obligation. On top of this, the draft proposes that the Government may prohibit or restrict electricity imports and exports while giving Regulator the right to impose price caps for DAM, IDM, ancillary and balancing markets. This draft passed the vote in Rada’s Energy Committee[5] and awaits the approval in the plenary.

We argue that such approach is wrong. What the Ukrainian electricity market needs right now are less, not more price caps. It needs fewer limitations and exemptions and more uniformly applied principles, competition and level playing field. It is true that wholesale electricity prices have surged since the market opening but we don’t know what price we would have today in conditions of real competition, without PSO and price caps. It is possible that instead of 28% price increase (as claimed by some)[6] we would deal with only 10% increase (disregarding the tariffs, constituting today around 30% of the end-consumer price).

As has been said before, imports from countries where electricity is cheaper is an obvious fix to increasing prices. And from this point of view, thirst of large energy-intensive consumers for less expensive commodity is understandable. However, benefits of electricity imports from Russia may be short-lived and in the long-term bring more harm than good. First of all, the more electricity is imported from Russia, the less motivation for pursuing deep energy sector reform. Vested interests aimed at sustaining the current, sub-optimal electricity market set-up are likely to prevail. Plans for physical and normative integration with the EU may become less ambitious with more electricity coming from Russia and Belarus. Since the electricity price in Russia is not primarily driven by the market, the export prices may be continuously low enough to hurt domestic production. Last but not least, the more Ukrainian enterprises become dependent on cheap Russian electricity[7], the more will Ukraine become exposed to possible political blackmail. This has happened and continues to happen in the gas sector (see ongoing negotiations on the gas transit contract with Gazprom) and there is no reason why Russia should not replicate this strategy whenever fit.

Rather than proposing additional price caps (which already are applicable) and fixing the malfunctioning electricity market through cheap imports, the Government should focus on gradually dismantling various PSO obligations, price caps and other limitations and put extra effort into completing infrastructure projects that will increase possibilities of physical electricity exchange with countries where price development is driven by the market. One quick win could be the construction of a 600MW DC link on the border of the IPS of Ukraine and the Burshtyn energy island (SS 750kV Zakhidnoukrainska).[8] At the same time, Ukrenergo should pursue synchronisation with the ENTSO-E, keeping in mind 2024 as the go-live date. In the meanwhile, additional smaller but important steps could be taken, for example, market coupling with Moldavia or introduction of a liquid trading platform for bilateral contracts.

Author: Kristian Takac

[2] Ukrenergo; 2017/2018 autumn-winter period passing of the IPS of Ukraine outlook

[4] https://twnews.se/ua-news/nesmotria-na-zaiavlenie-gerusa-import-elektrichestva-iz-rossii-uvelichilsia-vtroe

[7] Ukrenergo estimated that in July 2019, the average end-user electricity price (with all tariffs included) for industrial consumers was around 1968 UAH/MWh (73 EUR/MWh) while in Russia, the price is around 60 EUR/MWh (all taxes included).