Oil under the gun. How Israel's attacks on Iran affect the market

What does the escalation in the Middle East mean for Ukraine?

Last Friday, June 13, the Israel Defense Forces launched a massive strike on Iran, striking the nuclear center in Neteng and eliminating six high-ranking IRGC generals. This marked the beginning of another escalation in the Middle East, the course of which no analyst dares to predict.

The fact that this is a non-trivial “explosive” geopolitical event was evidenced by the reaction of the oil market, which remains one of the key commodity markets in the world even in the conditions of the modern energy transition from fossil fuels to renewable sources. Brent crude futures immediately after the Israeli attacks increased by more than 10% and exceeded $78 per barrel. This dynamics became the largest daily jump in oil prices since February 2022, when Russia launched a full-scale war against Ukraine. At the beginning of Monday, June 16, Brent quotations fluctuated at around $75, and traders are preparing for further growth due to the escalation of the conflict.

Ukrainian Energy has figured out how geopolitical risks coming from the Middle East affect the oil market, and how these trends may affect the course of the war that Russia has waged against Ukraine.

Escalation risks

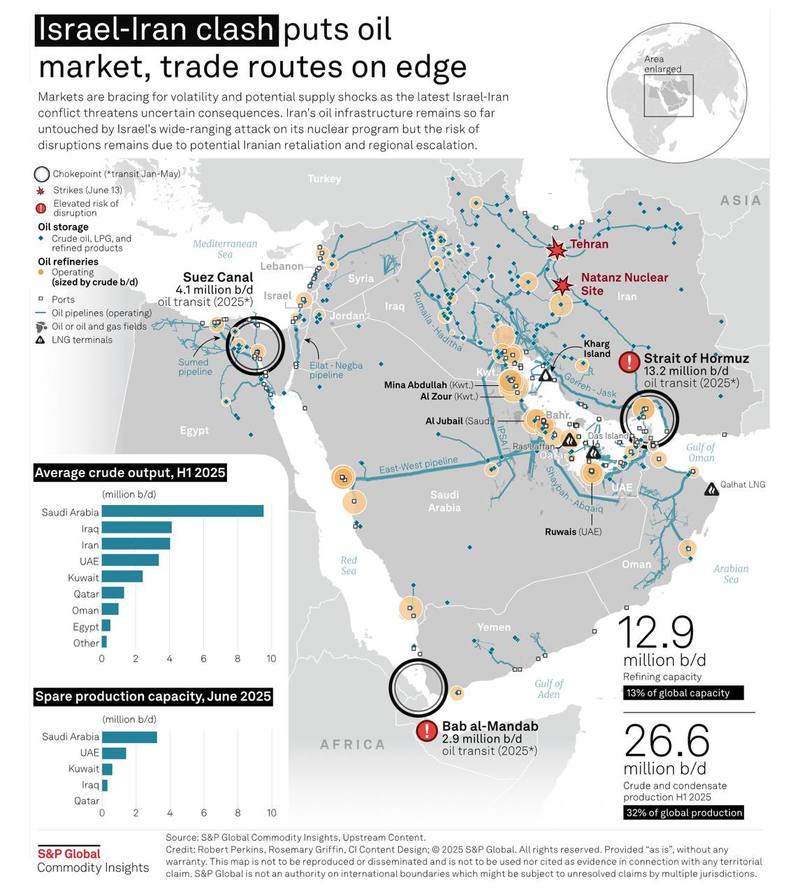

The main question that worries the market is whether the Strait of Hormuz, which is currently at the center of global tension, will be closed to oil transportation. This is a major shipping route that serves 30% of the world's oil trade.

Analysts believe that the risk of disruption of these supplies after the Israeli attacks is increasing. Israeli Prime Minister Benjamin Netanyahu said that strikes on Iran's military and nuclear facilities "will last as long as necessary." In response, Iran called the strikes a “declaration of war” and launched more than 100 drones toward Israel on the morning of June 13 alone. For its part, Israel was also able to temporarily disable a gas processing plant linked to the giant South Pars field, Iran’s largest, and damage fuel storage tanks.

If Iran’s oil infrastructure is significantly damaged, investment bank Goldman Sachs estimates that supplies could be cut by 1.75 million barrels per day for at least six months before gradually recovering. Assuming the OPEC+ alliance covers half of this shortfall from its reserves, the bank predicts that Brent could briefly exceed $90/barrel before falling to $60 in 2026. “Oil prices could rise further if there is a large-scale negative impact on regional production or transportation,” Goldman analysts say.

Analysts at S&P Global share a similar view. While Iran is expected to respond further, they believe that price increases will be limited, but only if oil exports are not affected. “In previous exchanges of strikes between Iran and Israel, prices initially jumped but quickly declined once it became clear that the situation was not getting out of hand and supplies were not being affected,” the S&P Global report says.

But, as its authors warn, an escalation could lead to higher freight rates, tanker insurance premiums and lower refining margins, especially in Asian countries. “If Iranian oil exports are stopped, Chinese refiners, the only buyers of Iranian oil, will have to look for alternatives in other Middle Eastern countries or Russia,” S&P Global concludes.

Energy War

So far, neither side has targeted energy infrastructure. Experts see this as a sign of restraint and awareness of the risk of harm to its own domestic needs and export potential.

Israel, which supplies gas to Egypt and Jordan, has shut down the Leviathan field as a precautionary measure. Iran said its refineries and storage facilities were still operating after being partially damaged.

“Now that this threshold has been crossed, the question is whether Israel is going to target more of Iran’s energy infrastructure. It seems we have entered a cycle of escalation,” said Richard Bronze, head of geopolitics at consultancy Energy Aspects.

“Attacks on energy infrastructure are not just about exchanging blows. Israel could strike an Iranian terminal, and Iran could strike an Israeli gas field in response. These assets are linked to global markets, and their operations directly affect prices. If Iran closes the Strait of Hormuz, the US will intervene with full force,” warns Colby Connelly of the Middle East Institute.

Despite US sanctions, Iran remains the third-largest producer among OPEC members. Its allies in Yemen, the Houthi rebels, have harassed ships in the region, and Tehran has threatened to shut down the Strait of Hormuz in the past, but has never blocked it.

S&P Global believes that restricting commercial shipping in the Strait of Hormuz is seen as one of the most extreme military responses available to Iran.

“The likelihood of further escalation, a prolonged conflict and its extension to attacks on economic targets with civilian casualties should further drive up the risk premium in oil contracts early this week,” said Bob McNally, president and founder of Rapidan Energy Advisers and a former White House energy official.

Traders surveyed by Bloomberg said oil prices have not yet factored in the risks of a complete closure of the Strait of Hormuz. Iran is unlikely to risk blocking the strategic route, which is critical not only for its own oil exports to China but also for its partners in the other Gulf states.

“Unless Iran convinces the Gulf Cooperation Council that such action is necessary for self-defense, closing the strait would be seen not only as a flagrant violation of international norms but also as a direct threat to the economies of the region,” JP Morgan analysts warned.

Political positions

Fatih Birol, head of the International Energy Agency, created by oil-consuming countries, said that world markets are now well-supplied with oil amid slowing demand due to the economic downturn and increased production by the OPEC+ alliance. He assured that the IEA is ready to use strategic reserves if necessary.

On Sunday, US President Donald Trump published a post on the social network Truth Social, in which he noted that “both warring countries should conclude a peace agreement.” He also reported that before the attacks he warned Israel that he would be unhappy with the rise in oil prices.

For its part, the Israeli authorities say that the target of the strikes is not energy and oil infrastructure, but objects of Iran’s nuclear program, which, according to Prime Minister Benjamin Netanyahu, pose a threat to the Jewish people in the form of a “nuclear Holocaust.”

How Iran Developed Its Nuclear Program

Iran began developing nuclear technology in the 1950s and 1960s with US support under the Atoms for Peace program. In 1970, the country ratified the Nuclear Non-Proliferation Treaty. After the 1979 Islamic Revolution, cooperation with the West ceased, but in the 1980s, Iran resumed independent nuclear research.

In parallel with the launch of the nuclear program, the new Iranian government set a course for conflict with Israel, calling for its destruction and began supporting the forces fighting against it. Israel has since viewed the possible emergence of Iranian nuclear weapons as a threat to its own existence.

In 2002, it became known about a secret nuclear facility in the city of Natanz - it was he who became the main target of the recent Israeli attack. Since then, Iran’s program has been under close international scrutiny.

Between 2006 and 2012, the UN imposed several sanctions on Iran for its refusal to halt uranium enrichment. These were in addition to the US sanctions already in place since the 1979 revolution and the seizure of the US embassy in Tehran.

Why the nuclear deal collapsed

In 2015, Iran and six major powers (the US, UK, France, Germany, Russia and China) signed the Joint Comprehensive Plan of Action (JCPOA), a document that limited Iran’s nuclear program. The agreement committed Iran to reducing its uranium enrichment level to 3.67% and reducing its stockpiles in exchange for partial sanctions relief.

In 2018, President Donald Trump unilaterally withdrew the United States from the deal, calling it “the worst deal ever,” and promised to negotiate new, more favorable terms. But neither he nor the incoming administration of President Joe Biden have been able to reach a new deal with Iran.

Tehran then began enriching uranium to 60%, which is almost the level needed to create a nuclear weapon (90%). According to the IAEA, by early 2025, Iran had accumulated approximately 275 kg of uranium with this level of enrichment, potentially enough to produce 5–6 nuclear warheads.

In the spring of 2025, the United States initiated negotiations again, at Trump’s instigation. Washington is insisting on a complete halt to uranium enrichment and destruction of stockpiles in exchange for sanctions relief. Iran rejects these terms, proposing to return only to the previous restrictions set out in the JCPOA.

Why Israel attacked now

After the escalation in October 2023, relations between Iran and Israel entered a phase of open clashes: air strikes, drone attacks, assassinations of high-ranking officials. In April 2024, the countries exchanged direct strikes for the first time.

By the beginning of the summer of 2025, according to the assessment of the Israeli government, the situation had become critical. “If Iran is not stopped, it will be able to create nuclear weapons in a few months, at most in a year. This is a direct threat to the existence of Israel,” Netanyahu said in his address.

According to The Times of Israel, Israeli intelligence services decided to act preemptively - before Iran has time to restore its air defense systems, damaged during the strikes in the fall of 2024. In addition, Israel now has “extremely accurate intelligence” on the Iranian nuclear program - and they decided to use this.

What are the consequences for Ukraine

The President of the Center for Global Studies "Strategy XXI" Mykhailo Honchar believes that in the event of further escalation of the Iranian-Israeli confrontation, disruptions in the Gulf oil traffic cannot be avoided. Because of this, oil prices, if they do not remain elevated, will continue to grow. "A lot will depend on the reaction of OPEC+, the fullness of the strategic reserves of the USA, China, and the EU. Neither the USA, nor China, nor the EU need high oil prices. Only Russia and Iran will benefit from high prices. Therefore, Iran, with the tacit support and encouragement of the Kremlin, may resort to acts of revenge in the Gulf area, directed against the United States, which in one way or another supports Israel," the expert explains.

High oil prices will help the Kremlin replenish its military budget to continue the war in Ukraine. “And the destruction of Iran will only be a plus for Ukraine, since the Ayatollah regime is an important ally of Russia – we all know about the Iranian martyrs,” Mykhailo Honchar concluded.

Svitlana Dolinchuk, specially for “Ukrainian Energy”