Secrets of Kremenchug oil refinery. Why Kolomoisky’s company is hiding information

Pursuant to the law, in case the manufacturer remains at the market alone, he is allowed to not submit information to the statistics department.

Although there are several small domestic oil refineries, management of Ihor Kolomoyskyi’s factory enjoys the above provision for purposes of hiding oil throughput.

Starting from October 2014, Kremenchug oil refinery, which is owned by PJSC Ukrtatnafta, refuses to submit information concerning its operating results neither to the Ministry of Energy and Coal Industry nor to the State Statistics Service of Ukraine.

In favor of its actions, company’s management points to provisions of the Law of Ukraine On the Government Statistics.

Pursuant to the Law, in case when the only manufacturer remains on the market, he is allowed to not submit information to the statistics service, as type and volume of products manufactured would appear obvious, and consequently this information would allow influencing manufacturer in some way.

Management of Kremenchug refinery is apparently considering its factory to be the only manufacturer of petrol, diesel fuel and other oil products in Ukraine. In practice, many more Ukrainian enterprises are legally involved in fuel production business.

Which oil refineries are operating in Ukraine?

There are six major oil refineries in the country, and five of those are highly unlikely to ever operate again. There is also one big gas processing plant (GPP) owned by the state-run company Ukrgazvydobuvannya.

Drohobych, Nadvirna and Kherson oil refineries have been shut down back in 2005–2007, and they did not produce high-quality fuel and were not economically viable.

The only way to restart them is to erect new oil refineries in their place, which is doubtful. To do that, according to assessment performed by А-95 Consulting Group, minimally Bln. $1 investment for each refinery is required.

Same is true for Odesa oil refinery (OOR). The only difference is that it has been shutdown quite recently, in 2014. However, it has no chances, neither.

All modern oil refineries produce at least 75% of light oil products, which is half as much again OOR with its less than 50%.

Russian Lukoil, which previously owned this factory, managed to lower this factor through distributing produced unmarketable goods for further advanced cracking to own oil refineries in Bulgaria and Romania; however that would not be possible nowadays anymore.

To operate, the factory also requires raw stock, and it is not available. It is highly unlikely to renew supplies from Russia in the short term, and sea delivery is a way too expensive.

Factories will neither be modernized as, for one thing, the refinery is arrested under the criminal proceedings conducted by the National Police, and for another thing, the facility is mortgaged in favor of the Russian VTB bank.

The design capacity of Lysychansk OR (LiOR) was 24 Mio.T. of oil products per year. It was considered to be one of the biggest in Europe.

However, in the late 1990’s, when the factory was bought by Russian TNK, it lost 16 Mio.T. of its capacities. Nobody was going to invest in it. Eventually, due to the low efficiency, the refinery was shut down in spring 2012.

In 2014 Rosneft took over TNK and promised to restore the refinery operation. However, the facility has been sized by LNR combatants in summer 2014, and soon several missiles hit the crude oil tank park and the facility went absolutely out of service.

It is clear that this is the death of any hopes concerning Lysychansk OR. Considering political and economical reasons, no one would start-up the facility located on the front line.

However, apart from large refineries, there are many refineries smaller in capacity, however operating legally and producing fuel.

By that we mean Shebelynka GPP of Ukrgazvydobuvannya, as well as about 15 small-capacity facilities refining oil products.

According to Anatoliy Fryzorenko, Trade statistics department head of the State Statistics Department of Ukraine (Derzhstat), these refineries produce about 10-15% of oil products.

Gennady Ryabtsev, Director for special projects, STC Psykheya:

Their combined capacity is incomparable to that of Kremenchug OR, however their production is based on their own prices, and in case you would apply the averaging methodology used by Derzhstat, it will be very complicated to determine the real volume of products refined by Kremenchug. Therefore it is strange to see Ukrtatnafta hiding this information.

PJSC Ukrtatnafta

PJSC Ukrtatnafta (Kremenchug OR) is the only high-capacity oil cracking factory in operation.

43.05% of shares are owned by the government via Naftogaz of Ukraine NJSC, 56% of shares belong to off-shore companies of Privat (group) owned by Ihor Kolomoyskyi and Oleksandr Yaroslavsky.

These companies are, in particular:

- Kornelius Holdings Ltd (6.28 %)

- Besato Consulting Ltd (5.23 %)

- Dagosel Investment Ltd (5.21 %)

- Apsolins Ltd (6.76 %)

- Ralix Services Ltd (7.67 %)

- Lextermal Ventures Ltd (5,58 %)

All above companies have been established in 2010 under the jurisdiction of the Republic of Cyprus.

Earlier, Privat group, represented by the company Korsan, owned only 1.2 % of Ukrtatnafta shares. The real influence on the company had the Russian Tatneft, which controlled 55.7 % of company’s shares.

However, based on decisions of Ukrainian courts, share of Tatar shareholders was diluted, whilst entities belonging to Privat and Yaroslavsky became new shareholders.

2017 numbers:

3 969 employees at Kremenchug OR

UAH 595 603 thous. – wages fund for all PJSC Ukrtatnafta employees

UAH 12 505 – average company salary

2.35 Mio.T crude oil reprocessed

UAH 29.99 Bio. – net proceeds from oil products sale

(based on SMIDA system data, Dmytro Sinchenko)

In 2017, Ukrtatnafta increased its net loss by 12.6 times, to UAH 2.44 Bln. At that, Ukrtatnafta’s net profit for the past year has increased by 39.6% - to UAH 33.23 Bln.

Ukrtatnafta is operating Kremenchug OR with its operating capacity of 10.5 Mio.T. of crude oil per year.

Crude oil and gas condensate provided by the company Ukrnafta are used as crude material for the facility, as well as crude oil supplied by sea from Kazakhstan and Azerbaijan.

Crude oil consumption, according to the State Fiscal Service (SFS), reached 3 088 thous.T, including 1 013 thous.T of imported crude oil.

Thus, less than one third of refinery capacities are nominally used.

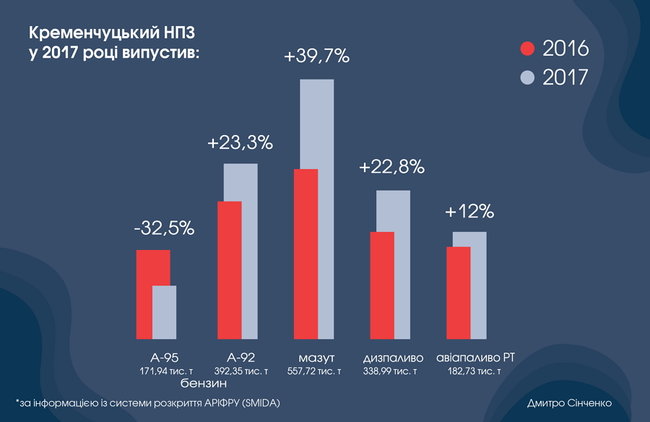

In 2017, Kremenchug OR produced:

A-95 (thous.T)- A-92 – Fuel oil – Diesel fuel – Aviation gas

Petrol

* based on SMIDA system data, Dmytro Sinchenko

But verifying this information based on data from other official sources seems impossible.

Kremenchug products are sold through the chain of filling stations owned by Privat Group (Avias, ANP, Sentoza etc.).

This group could also incorporate Ukrnafta filling stations, as over 40% of shares and operative management of that are in practice exercised by Dnipro (residents).

Finally, according to the Consulting Group E-95 assessment, the Privat-owned chain incorporates 1540 filling stations, or 26.6% of the total number of filling stations in Ukraine.

Utilized capacity of Kremenchug OR could be increased, as capacities and contracts with crude oil suppliers are available, after all.

Thus, Ukrtatnafta has a contract with SOCAR company (Azerbaijan) for the annual supply of 1.3 Mio.T of crude oil during 2017-2019. This is over 100 thous.T monthly. Company has also agreements for the crude oil transportation with the state-owned company Ukrtransnafta.

However, according to the Consulting Group A-95, utilization of Kremenchug OR capacities is not increasing due to complications in sales and failing attempts to conclude long-term contracts for oil products’ supply.

And all that is with regard to the profitability of working with the domestic manufacturer, as well as Euro-5 standard, to which Kremenchug-produced oil products comply since 2017.

Probably, reasons of “stagnation” include also certain discrepancies between Ihor Kolomoyskyi and Oleksandr Yaroslavsky being Ukrtatnafta management partners.

Another factor is the unfavorable period for expanding businesses, considering the conflict between Privat (group) and authorities.

Consequences of Ukrtatnafta hiding information

Sergey Kuyun, Director of JSC Consulting Group A-95:

Until 2014, the refinery reported to the State Statistics Service and the Ministry of Energy on a daily basis. However, it stopped providing statistic information in 2014. This issue has been raised many times even by ministers and Natfogaz of Ukraine NJSC being Ukrtatnafta shareholder, however with no result. Meanwhile, it is important for both – the market and the government – to understand what is going on at the biggest Ukrainian oil refinery, considering that provisioning with fuel is a strategic issue.

Without Kremenchug OR reporting, neither the government nor the public is aware of the volume of oil products available at the market. This does not allow implementing energy security measures.

According to goals determined by the Energy Strategy of Ukraine for the period until 2035, the government has to assure delivery of one product from the same source in the amount not exceeding 30%.

However, volume of oil products produced today in Ukraine is not clear.

Gennady Ryabtsev, Director for special projects, STC Psykheya:

Traders and analytic companies are able to assess a preliminary amount, however not the precise volume. How do they manage? They see the volume of crude oil extracted in Ukraine (however Ukrnafta is insufficiently transparent), then they assess the amount imported, subtract the volume of oil refined by Shebelynka factory and multiply the resulting figure by the oil refining depth ratio. It was 0.74 for Kremenchug OR in 2013. Thereafter, multiply by the coefficient and receive preliminary numbers. However, approximate or insider information is not official, and can not be used as reference. We have the SSS data for all types of products except for oil products. Neither Ministry of Energy and Coal industry has it.

For some reason, nobody is reacting to such state of affairs. Lawsuits or any attempts are not known of forcing the factory to prove that this information is a commercial secret.

Anatoliy Fryzorenko, Director of the SSS Trade statistic department:

We have mailed and communicated per telephone with the chief accountant and the PJSC Ukrtatnafta first deputy. Accountant advised to talk to the management. We did not even receive answers to our letters. That is, some instruction was given to not report. What is it related to – nobody is telling us. We have the right to impose fines on them; however we need to hand over the message in hand. Nobody is allowed to enter the facility territory. This is the closed facility inside the country. No one has influence on them. As a consequence, we do not have a complete assessment of, e.g. raw oil consumption. Ukraine is the member of the Energy Community and we are obliged to provide information concerning oil products balance on the monthly basis: production, export, import, consumption. We provide assessment data. However, we would like to use first-hand sources.

Such attitude gives reason to suggest that the facility is hiding undocumented but excisable raw materials and oil products.

These suspicions are deepened by the fact that in 2016 a powerful oil products’ tank-truck loading enterprise was erected near the facility.

In difference to the railway transportation, which is clearly recorded, transportation by gas trucks does practically not leave traces for further revisions. That is, the raw stock is delivered unnoticed and the similarly unnoticed oil products are living the facility.

Sergey Kuyun, Director of JSC Consulting Group A-95:

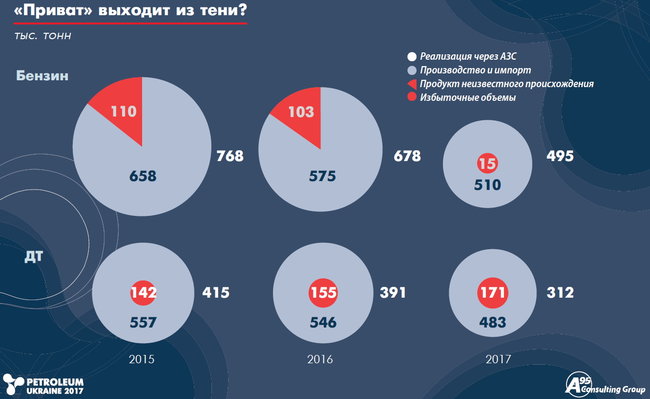

Statistics is also giving reasons for such suspicions. I have compared input (oil products refined in Kremenchug and imported by Privat) to their sales via filling stations chain. As we see, it is unclear where the group received over 100 thous.T of gasoline from 2015 to 2016, which is almost 20% of their sales volume. What is the source of this fuel? As for diesel, this can easily be explained by wholesale, but they have not sold gasoline in bulk, these volumes would have been noticeable. This story with the reporting is quite strange and incomprehensible.

According to Olena Osmolovska, Head of Naftogaz of Ukraine NJSC Corporate Communications department, the company has several times requested to call the PJSC Ukrtatnafta general shareholder’s meeting.

However, package of shares owned by NAK does not provide a quorum in case the general meeting of shareholders is called. No general meetings have been called during 2011-2018 and therefore Naftogaz of Ukraine NJSC is not represented in the company’s authorities.

Does Privat come out of the shadow?

Thous.T

Petrol

- sales via filling stations

- production and import

- products of unknown origin

- excessive volumes

By hiding the actual production volumes, Ukrtatnafta hides revenues from sales. For instance, the company might claim to have produced the aviation kerosene and to have paid a corresponding excise tax (Euro 21,- per 1000 l), and in fact it has produced diesel fuel, for which the excise duty is Euro 139.5.- on one ton.

So, there is a possibility of hiding part of an income and opportunities for producing products, which do not correspond to technical guidelines, possibilities for processing the unaccounted crude oil. This is difficult to verify.

“It is not a fact that they use all these opportunities. There are no facts as there is no accounting. Situation is advantageous for the company. For some reason, everyone is interested in gas (prices) or tariffs, and no one is paying attention to this. This is just an element of problems related to the Privat Group” – explains Gennady Ryabtsev.

Problems of the Privat Group

PJSC Ukrtatnafta ignored all our information requests and attempts to receive comments. However, despite the company’s efforts to hide its financial indicators, some of them can be found in the analytical system Youcontrol database. Amongst others, the non-correlation between company’s sales and income catches the eye.

That is, according to Youcontrol data, Ukrtatnafta sales raised in 2014 by 12.18%, in 2015 – by 24.35%, and in 2016 have dropped by 7.1%.

At that, income in 2014 decreased by 59.92%, in 2015 – by 498.56%, and in 2016 increased by 134.2%.

Generally, company’s profitability and net margin are decreasing starting from 2014, and debts are increasing instead. Servicing of existing debts is burdening the company heavily.

Describing Ukrtatnafta’s activities, experts recall many other problems related to this company.

Gennady Ryabtsev, Director for special projects, STC Psykheya:

This includes concerted actions of dozens of legal entities, which manage 1625 filling stations of Privat; those actions remain strangely unnoticed by the Antitrust Committee. It is also non-correspondence between volumes of the produced and imported and sold products, questionable results of auctions, which conceal real volumes of raw stock delivered to the facility. It also includes raw oil, which according to preliminary conclusions of investigators was pumped out of main pipelines illegally and stored then in Kremenchug. It is hard to say what happened to that oil later …

According to expert’s opinion, refinery as a single economic facility does not exist any longer. Each installation is either leased or subleased. It is practically impossible to determine owners of installations, trestles, reservoir tank storage.

Sergey Kuyun, Director of JSC Consulting Group A-95:

Practice of regular (once per half-year) rotations of legal entities, which manage Privat’s filling stations, is also drawing attention. These are over 50 companies with a minimal authorized capital replacing one another (the last case and the background is here). There is no doubt that this is arranged to “double back” in case of fiscal or Antitrust Committee revisions. I do not exclude that traces of non-accounted oil products are lost this way, as well.

According to Youcontrol analytical system data, 77 legal entities have the word “Ukrtatnafta” in its name or in the name of its founders.

However, the biggest problem of Kremenchug OR is within the fact of its take-over by Ihor Kolomoyskyi’s Privat Group and affiliated companies, for which the Ukrainian state will be forced to pay at least $150 Mio. to the Russian Tatneft.

Four years ago, the International Commercial Arbitrage in Paris ordered Ukraine to pay to the Russian Tatneft $112 Mio. The trial lasted six and a half years, and then the Ukrainian side appeal lasted for two years longer.

Currently, there is the period of coercion to implement this decision. Tatneft will obviously attempt to arrest Ukrainian assets to recover the entire debt amount.

The plaintiff has also claimed to recognize and force the arbitration awards in other jurisdictions – to the national courts of other countries. In the United Kingdom, a decision has been taken still in May 2017 to enforce the arbitration award in favor of Tatneft.

Ukraine submitted appeal, which is currently handled in the USA. In the USA, Tatneft is also trying to find Ukrainian property, however the domestic court has not published its decision yet.

At the beginning of 2016, another claim has been submitted apart from Tatneft claim – this one made by the Ministry of Land resources and property relations of Tatarstan republic (RF). Earlier, this Ministry owned 28% of Ukrtatnafta.

Hearings in this case should take place soon. If judges decide in favor of Tatarstan, Ukraine will have to reimburse to the republic another $141 Mio. plus interest.

At that, Ukraine will have to pay for liabilities of a company, on which the government does not have any influence despite the fact that Naftogaz NJSC owns 43% of its shares.

To avoid millions of losses for the state budget, situation requires immediate solution, and all suspicions need to be investigated by law enforcement officers.

Author: Dmytro Sinchenko

The above text is prepared in the frameworks of the USAID project “Transparent Energy Industry”. Author’s viewpoint might not coincide with the viewpoints of the US Agency for International Development or the DiXi Group analytical center. In case of the investigation reprint, the disclaimer reprint is mandatory.