Green guarantees. What's happening in the electricity market

Which EU countries will be the largest buyers of Ukrainian certificates?

According to the Boston Consulting Group (BCG), the green energy sector in Ukraine will double by 2040: the share of renewable energy generation in the production structure will increase from 15% (2022 figure) to 28%, and will continue to grow, and the Ukrainian power grid will become significantly “greener” than in many European Union countries. This was stated by BCG Senior Expert Balit Silhavi at the conference of the analytical center “We Build Ukraine”.

Incentives for the development of renewable energy are created not only by the destruction in the energy system caused by Russian aggression, but also by state policy aimed at deepening integration with the EU, where the rejection of fossil fuels is the main trend. The development of trade in guarantees of origin of electricity from renewable energy sources (GO) is one of its key tools, contributing to transparency and strengthening green generation in the energy system.

Ukrainian Energy has analyzed the current trends that determine the situation on the GO market in Ukraine and the European Union, and also found out which EU countries may become the largest buyers of Ukrainian guarantees of origin, and what prices Western consumers are willing to pay for them this year.

Opportunities from the time of war

Guarantees of origin certify the rights of their owner to environmental value, i.e. the reduction of CO2 emissions, which was avoided thanks to the production of electricity from renewable sources instead of traditional generation that consumes fossil fuels. In essence, it is an electronic certificate that is issued for every 1 MWh of green electricity released into the network during a calendar month. The main goal is to reveal to end consumers the renewable origin of electricity. The circulation of GO creates a traceability mechanism in energy markets, and also supports the decarbonization policy and the transition to renewable sources.

In Ukraine, the GO market became operational in the fall of 2024, in the third year of the full-scale war, which accelerated the country's integration with the European Union. Since then, trades in guarantees have been regularly held on the exchange platform of the state joint-stock company "Market Operator", and their initiator is the state enterprise "Guaranteed Buyer", which maintains the register of RES producers in Ukraine.

The primary issuers of GO are RES owners. The sellers of GO, which disclose information about the transactions, are the largest players in the renewable generation sector - the state company "Ukrhydroenergo" and D. Trading, which are part of Rinat Akhmetov's private energy holding DTEK. Among the GO buyers were cement manufacturer Knauf Gips Kyiv, "Vinnytsia Poultry Farm" from the agricultural holding "MHP", Zaporizhzhia Abrasive Plant, and electricity suppliers.

According to the Market Operator, the selling price of GO on the Ukrainian market, as a rule, does not exceed the starting price - UAH 13 per unit, and only sometimes can it rise to UAH 14.

The problem is in the low liquidity of the market, the lack of regulatory incentives that would increase consumer interest in GO, as well as in limited domestic demand due to the fact that Ukrainian guarantees are not recognized in the EU (this makes international trade impossible), and Ukrainian industrialists cannot use GO to optimize the tax burden when exporting and paying the environmental tax in Ukraine.

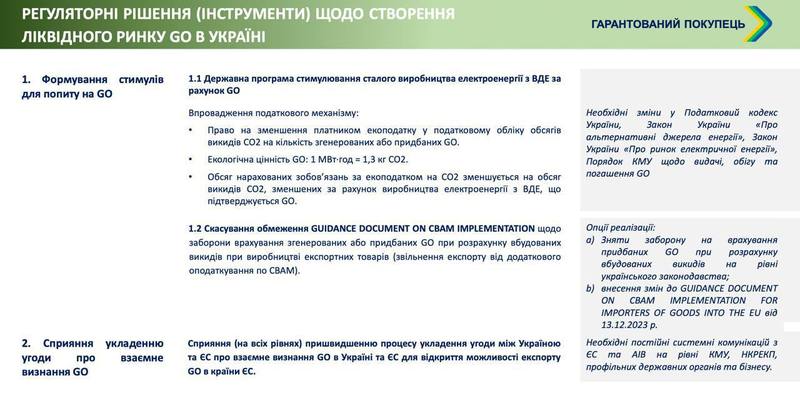

“In general, about 2% of GO from the total volume offered for sale is currently sold on the Ukrainian market,” said Artem Nekrasov, acting director of the Guaranteed Buyer State Enterprise at the Energy Development League event. To improve the situation, he proposes to introduce legislative incentives at the state level that will revive business interest in purchasing GO. These initiatives should concern not only systemic changes in environmental taxation, but also support for Ukrainian producers interested in supplying their goods to the European Union (see infographic below).

Among the main buyers (end consumers) of GO in the future, Artem Nekrasov named industrial enterprises from the metallurgical, chemical, transport and construction industries; businesses that support trends in reducing greenhouse gas emissions and decarbonization; electricity suppliers that offer customers "green" service packages; state-owned enterprises, organizations and institutions that are interested in strengthening the environmental image of Ukraine.

Benefits of European integration

"Guarantees of origin for investors in renewable energy are a completely market-based incentive tool that can accelerate the development of renewable energy in Ukraine. But in order for this tool to work, efforts must be directed towards their international recognition and creation of demand in the domestic market,” said Oleksandr Selyshchev, CEO of DTEK Renewable Energy, in a comment to Ukrainian Energy.

He is confident that the interest of socially responsible businesses in guarantees of origin will only grow every year. This will increase the demand for electricity from renewable sources and create conditions for the construction of new green energy capacities in Ukraine.

But in order for the GO market to receive a boost to rapid development, Ukraine must complete the certification of the national Register of Guarantees of Origin by the end of 2025. “This will unlock the technical possibility of exchanging GO with the countries of the Energy Community, and will also allow us to agree with Brussels on the legal conditions for mutual recognition of Ukrainian GOs in the EU and vice versa,” Oleksandr Selyshchev explained.

At the government level, it is expected that after the deployment of a full-fledged national GO register this year, cross-border circulation of certificates will be launched in 2026, and by 2027 the Ukrainian GO market will be fully integrated with the European one, and Ukrainian companies will be able to voluntarily export GO. This is an optimistic scenario. However, obstacles may arise on the way to its implementation due to the war and instability of the energy system, which makes it difficult to forecast the volume of renewable energy generation, the lack of a stable domestic GO market, and bureaucratic delays.

Last month, the National Commission for the Regulation of the Energy and Utilities Market (NKREKP) took the first step towards integrating the Ukrainian GO market with the European one. On April 22, a bill was approved on mutual recognition of GO between Ukraine and the EU and the countries of the Energy Community.

“The document creates the basis for a potential expansion of demand for guarantees of origin issued in Ukraine,” the text of the bill states.

Foreign interest

Experts identify several European countries as the most promising markets for Ukrainian GO.

First of all, it is the Netherlands, which is one of the largest importers of GO in Europe due to significant demand from corporate consumers (Philips, Heineken, ING) and a high level of voluntary interest in “climate-friendly” services of electricity suppliers, which is not related to market regulation.

Germany is a large consumer of renewable electricity and GO due to high environmental requirements for business established by national legislation.

In Italy, demand for GO is growing rapidly, especially among small and medium-sized enterprises, also due to tightening regulatory rules. However, the country lacks domestic “green” electricity production, so its enterprises are looking for opportunities to purchase GO on foreign markets. A similar situation has developed in Belgium, where a developed industrial market requires significant volumes of GO imports. On the other hand, Switzerland and Austria are characterized by active eco-consciousness in business, so their companies are characterized by a high share of voluntary use of GO and other “green” certificates, which confirm their contributions to environmental protection and CO2 emission reduction.

For enterprises and organizations from the mentioned countries, Ukrainian GO will have not only “green” value, but also social added value, which will demonstrate their contribution to supporting the development of renewable energy and sustainable post-war reconstruction of Ukraine.

Price recovery

At the beginning of 2025, GO prices in the EU reached historic lows. If in 2023 they fluctuated on average within €7–10 per MWh, then during 2024 they even fell below €1 per MWh for contracts with delivery in 2025.

“2024 turned out to be a difficult and rather gloomy year for the GO market. Prices systematically decreased, returning to levels last observed in 2021. However, this was not due to a lack of interest from consumers. According to the Association of Issuing Bodies, the number of GO sales grew faster than the number of their issuance,” says an analytical report from the consulting agency Montel.

Its authors indicate that the mentioned negative price trend arose in response to the excess of GO market offers due to the significant growth of RES production in Europe, especially at hydro and solar power plants. In addition, commercial demand has weakened due to the European Commission’s easing of climate and environmental legislation.

According to Montel, EU GO prices will remain low at least until the first half of 2025, reflecting the ongoing oversupply. However, they could rise to €2-5 per MWh in the medium term due to increased regulatory pressure on businesses to accelerate their decarbonisation and greenhouse gas reduction measures.

Following the adoption of the CSRD by the European Commission, GO use is gradually moving from voluntary to mandatory. Demand-enhancing regulations will start to take full effect in the second half of 2025.

The market therefore expects a renewed upward trend in GO prices over the next few years. This will be influenced, in particular, by consumers' willingness to pay higher prices; changes in renewable energy regulation and sustainability reporting; and increased demand that will exceed the growth rate of supply.

In addition, according to the EU taxonomy, the structure of energy sources will determine the interest rates that companies face when attracting bank loans. Therefore, confirmed consumption of RES will also mean wide opportunities for businesses to access cheaper financing for investment projects.

Svitlana Dolinchuk, specially for "Ukrainian Energy"