A simple formula: why Ukrainians pay so much for heating

When receiving heating bills, all Ukrainians ask the same question: what exactly are we paying for, anyway? The bill amount depends on the tariff for centralized heating service (more detailed discussion is below) and the consumption amount determined on the basis of (individual and/or building) meter readings or, if a building does not have one, normative consumption rates.

So, Tetiana Boiko, Coordinator of Opora Civic Network’s Housing, Utility and Energy Programs tried to find out what Ukrainians are paying for.

The per-sq.m amount of heat consumption may differ drastically, depending on how energy-efficient a building is, and is the sole responsibility of consumers. Get together with the neighbors, create an association of apartment building’s co-owners, order an energy audit, develop a step-by-step algorithm of thermal modernization, receive a government or local budget support for a "warm loan" or another program – and cut the bill amount in half.

Nevertheless, instead of taking a long but correct path, many Ukrainians hope for reduction of heating tariffs. Almost 99% of the heating tariff is comprised of thermal energy. Heating tariff represents a monetary expression, i.e. the cost of generating, transmitting and supplying a unit (1 Gcal) of proper-quality thermal energy.

The Law of Ukraine On the procedure of accessing information regarding electricity supply, natural gas supply, heat supply, centralized hot water supply, centralized drinking water supply and water discharge stipulates the consumer’s right to have complete information regarding prices/ tariffs and their components. And the bodies of local self-government and service providers are responsible for providing this information to their communities. However, itemized calculations for every enterprise are hard to come by. Usually, this information is available in a very generalized form and gives no clue as to where the monopolist itself is going to spend every hryvnia paid to it.

Therefore, let’s assume that during a heating season, our household which receives heat from a boiler plant would pay UAH 12,000 for heating, and try to find out where this money would go.

How the heating tariff is formed

According to Ukrainian law, tariffs for thermal energy, heat generation, transmission and supply, centralized heating and hot water supply services are calculated by enterprises licensed to provide these services on the basis of annual plans and economically justifiable planned expenses. Based on these calculations, tariffs are set by licensing authorities: regional state administrations (RSAs) or the National Commission for Regulation of Energy and Utilities Sectors (NCREUS) as the state regulator. Simply put, tariffs for heat and hot water are calculated by the suppliers themselves and set, on the basis of their calculations, by either RSAs or NCREUS.

So, how can you find out who exactly has approved the tariff for your particular apartment building? Effective 15 May 2017, the number of the state regulator’s licensees has substantially decreased. Thus, the regulator issues licenses and sets heat generation tariffs for business entities with the heat generation output exceeding 170 thousand Gcal, heat transmission tariffs when over 70% of consumers have heat meters as of 1 August 2017 (over 90% as of 1 January 2018), and heat supply tariffs for business entities supplying over 145 thousand Gcal of thermal energy. In other cases, licenses are issued by regional state administrations.

However, it is worth noting that this year’s tariffs have been approved mostly by NCREUS’s resolutions. The tariffs are formed on the basis of the relevant procedures, separately for every licensed area of activity: generation, transmission, supply, and provision of services.

At the same time, bodies of local self-government greatly influence formation of tariffs. They approve draft plans of municipal enterprises and organizations owned by respective local communities, fuel and energy spending rates and local development programs in heat supply sphere, construction of new or reconstruction of existing heat supply facilities, investment programs concerning municipal heat supply facilities, operating temperatures of heat supply networks and amount of local taxes and duties.

What does heating tariff consist of?

Heating tariff represents the sum of thermal energy generation, transmission and supply tariffs. Thermal energy is generated by boiler plants, thermal power stations, cogeneration plants and nuclear power stations. The cost of heat directly depends on the method of generating it and on the length and technical condition of heat networks. Therefore, tariffs cannot be the same for all cities; on the contrary, they may significantly differ even within the same city. According to data by NCREUS, the average weighted heat tariff among licensees was 1036 UAH/Gcal as of mid-January 2017.

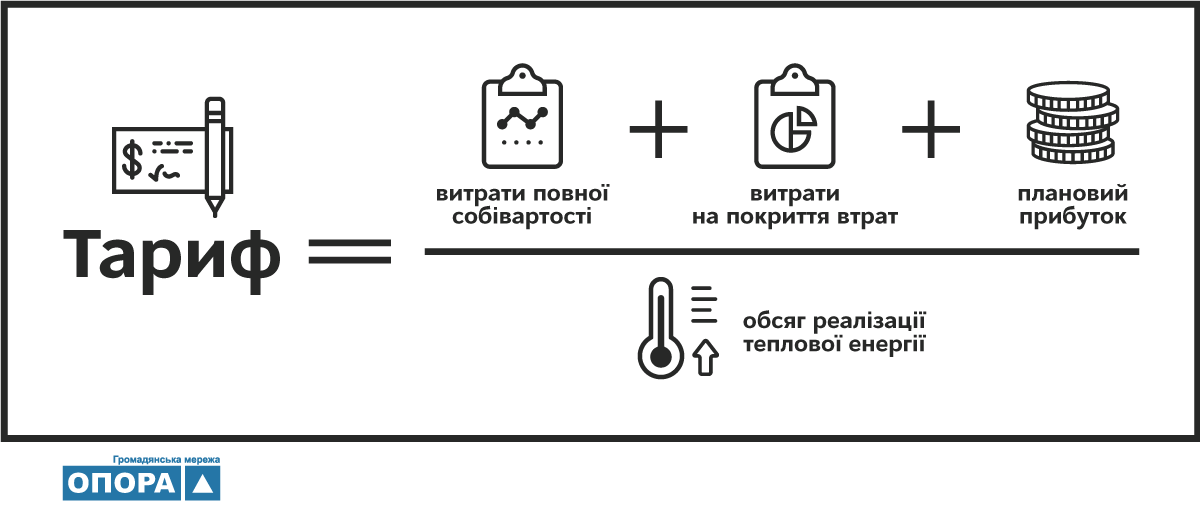

The tariff is calculated using the following formula:

Therefore, every numerator in the tariff (for generation, transmission and supply of heat) consists of expenses covering production cost price and losses, and of expected profit. Some companies set the expected profit at 0 UAH, while others at 1% of tariff.

Boiler plants play the main role in generation of heat. The country’s heat network includes over 30 thousand various-purpose boiler plants. 95.67% of the total tariff on average is spent on generation, 4.089% on transmission and 0.237% on supply of thermal energy.

The average heat generation tariff (for NCREUS’s licensees generating heat at own boiler plants) is 978.62 UAH/Gcal (w/o VAT). 85% of this amount is fuel cost. The main fuel consumed by boiler plants is natural gas (69%), while coal is responsible for 27% and liquid fuel for almost 1% of consumption. Other components of this tariff include: electricity costs (6%), technological water and water discharge (0.2%), materials and spare parts (0.1%), labor costs including deductions (7%), depreciation deductions (0.5%), other costs (1.2%).

The average heat transmission tariff is 41.83 UAH/Gcal. At the same time, almost 14% of the transmission tariff is spent on electricity, 0.4% on technological water and water discharge, 3% on materials and spare parts, almost 53% on labor costs including deductions, 13% on depreciation deductions, and 16.6% on other expenses.

The average heat supply tariff is 2.42 UAH/Gcal. At the same time, labor costs including deductions are responsible for 92.6%, materials and spare parts for 0.8%, depreciation deductions for 1.5%, and other expenses for 5.1% of the tariff.

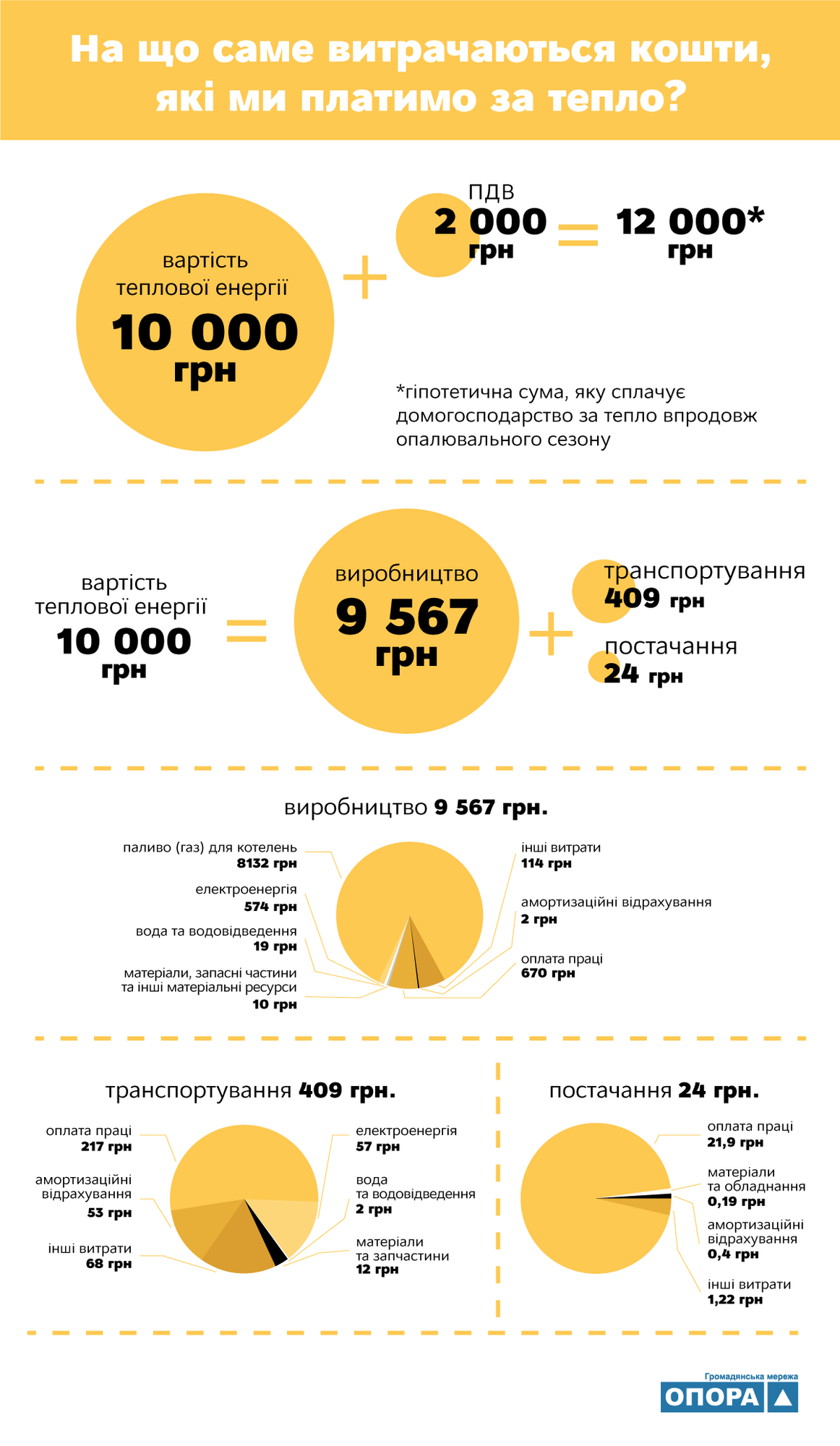

So, how our 12,000 hryvnias paid for heat during the heating season must be spent?

UAH 2000 (20%) is value added tax payable to the state budget of Ukraine, leaving UAH 10,000 for thermal energy. Of this amount, UAH 9567 is expected to be spent on generation, UAH 409 on transmission and UAH 24 on supply of heat.

At the production level, a heat supply enterprise would have to pay UAH 8132 for boiler plant fuel (gas), UAH 574 for electricity and UAH 19 for water. Only UAH 10 will be spent on materials, spare parts and other material resources, and further UAH 670 on remuneration of workers operating heat generation equipment. Depreciation deductions will amount to UAH 48, and other costs to UAH 114.

UAH 409 will be spent on transmission of thermal energy. Of this amount, UAH 57 will be spent on electricity and UAH 2 will be paid for water. Only UAH 12 will be allocated for materials and spare parts (even though 2/3 of all networks are almost worn out), and UAH 217 will be spent on salaries paid to workers handling transmission of heat. Depreciation deductions will amount to UAH 53, and other costs to UAH 68.

24 hryvnias are required to ensure supply of heat. This amount breaks down as follows: UAH 21.9 goes to salaries of heat supply personnel, UAH 0.19 will be spent on materials and equipment, UAH 1.22 on other expenses, and UAH 0.4 on depreciation deductions.

Summing everything up, after paying UAH 8132 in fuel costs, the remaining UAH 1868 must be spent on labor costs including social deductions (UAH 909), on buying electricity (UAH 631), materials and equipment (UAH 22), on depreciation deductions (UAH 101), and other expenses (UAH 184).

Spending almost everything on gas? And what about equipment upgrade and development?

Depreciation deductions and part of the profit (since it amounts to less than 1 percent, it was included to "other expenses") must be used to finance implementation of the enterprise’s investment program.

Investment program is a complex of measures aimed at increasing reliability and ensuring effectiveness of centralized heat supply systems, including the heat supplier’s commitment to build (reconstruct, modernize) facilities and improve service quality. This is a document containing relevant calculations and feasibility studies, stating sources of financing and including implementation schedule. An enterprise may also use other revenues from business activities related or unrelated to the licensed area of activity, loans and borrowed funds (in particular, received from international institutions), and financing from local budgets.

It is worth noting that tariffs are formed on the basis of planned indicators, but whether payments received from consumers will be used according to this plan is a different question. Unfortunately, publicly-accessible detailed information about “execution of tariff” is almost impossible to find. There is a number of objective and subjective reasons as to why modernization of equipment and networks often receives even less financing than planned. However, misuse of funds by monopolists is far from being a rare occurrence.

That’s why we as responsible consumers must demand from our heat suppliers a detailed structure of approved tariff, tariff execution information and report on implementation of investment program. Only then would our knowledge turn into power.

This investigation was conducted as part of the USAID project “Transparent Energy Sector”. The opinions expressed in this article are those of the author and do not necessarily represent those of the United States Agency for International Development and DiXi Group analytical center.