Environmental tax: where do moneys go and what should be changed?

The contents are the sole responsibility of DiXi Group and do not necessarily reflect the views of USAID or the United States Government.

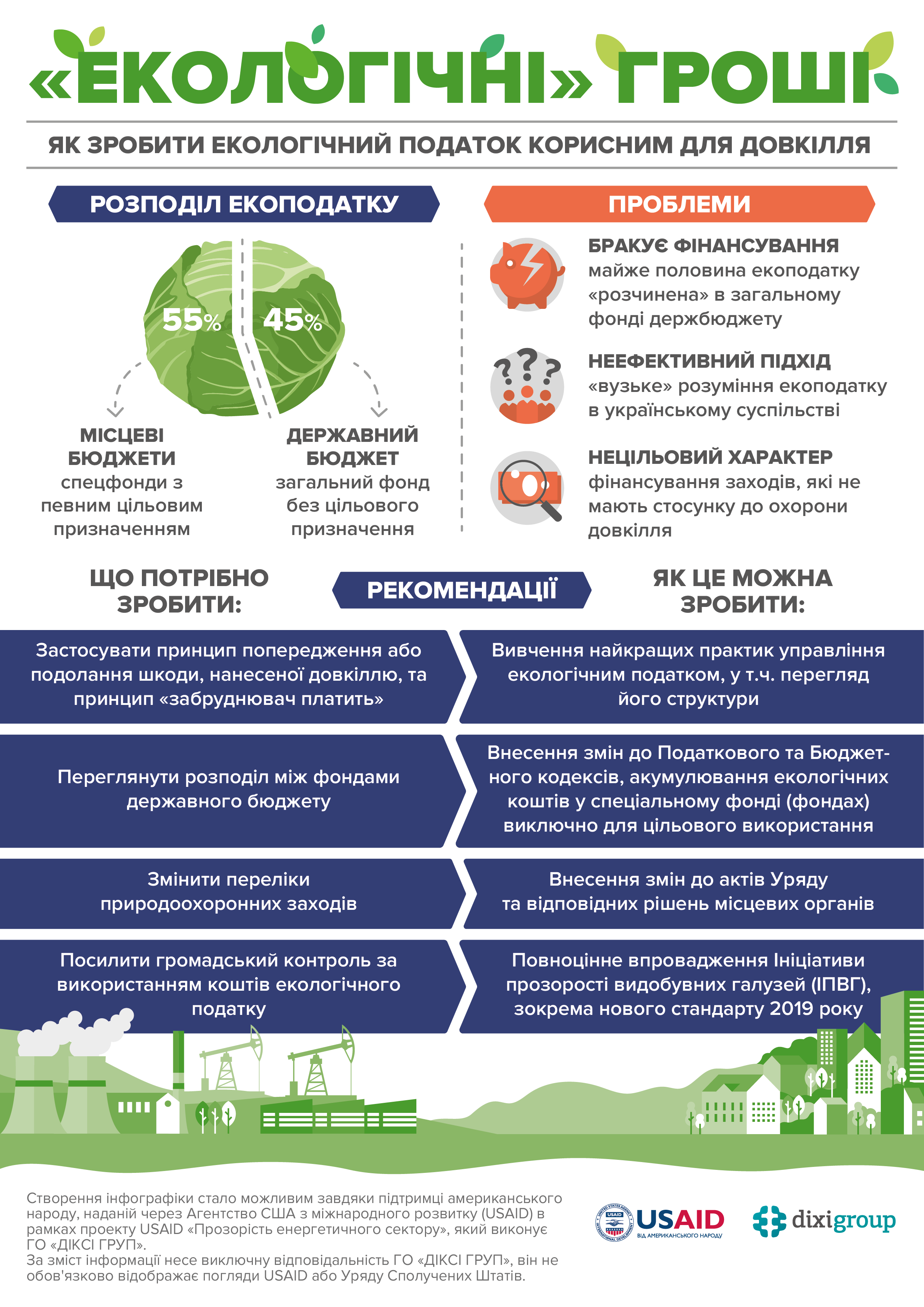

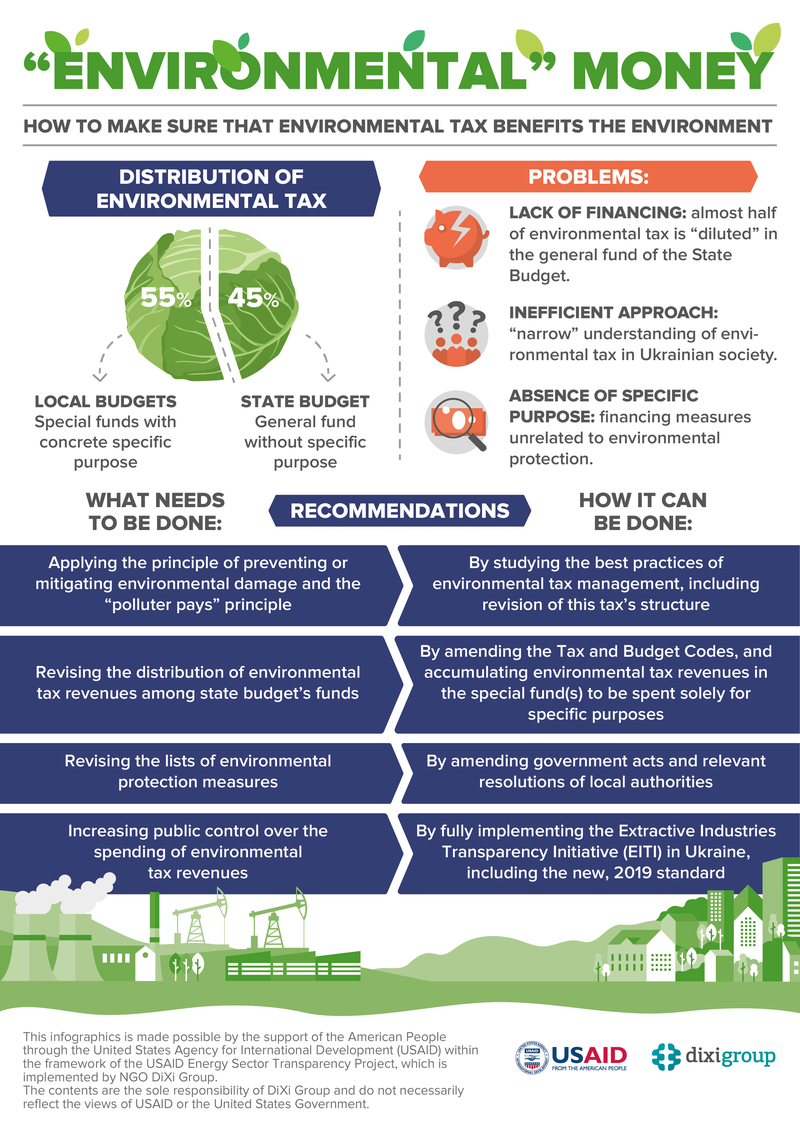

- How environmental tax is presently distributed and spent

To the state budget’s general fund:

45% of environmental tax;

100% of environmental tax charged for carbon dioxide emissions by stationary sources of pollution.

To the state budget’s special fund:

100% of environmental tax charged for generating radioactive waste (including the already accumulated waste) and/or for temporary storage of radioactive waste by its producers beyond the period set by special licensing terms.

To the special fund of local budgets:

55% of environmental tax; including 25% to village, city and unified territorial community budgets, 30% to regional and AR Crimea’s budgets, 55% to Kyiv and Sevastopol city budgets.

Allocations from the general fund are spent on financing various expenditures without concrete specific purpose.

Revenues of the special fund of the state and local budgets must be spent according to the specific purpose of financing environmental protection measures.

Challenges:

Lack of financing: almost half of environmental tax is “diluted” in the general fund of the State Budget.

Inefficient approach to environmental tax: “narrow” understanding of environmental tax in Ukrainian society.

Absence of specific purpose and insufficient transparency of spending: the list of environmental protection measures and the corresponding spending procedures allow to finance, inter alia, measures unrelated to environmental protection.

- Recommendations

What needs to be done:

- Applying the principle of preventing or mitigating environmental damage and the “polluter pays” principle.

- Revising the distribution of environmental tax revenues among state budget’s funds.

- Revising the lists of environmental protection measures.

- Increasing public control over the spending of environmental tax revenues.

How it can be done:

- By studying the best practices of environmental tax management, including variants of this tax’s structure.

- By amending the Tax and Budget Codes, and accumulating environmental tax revenues in the special fund(s) to be spent solely for specific purposes.

- By amending government acts and relevant resolutions of local authorities.

- By fully implementing the Extractive Industries Transparency Initiative (EITI) in Ukraine, including the new, 2019 standard.

This article is made possible by the support of the American People through the United States Agency for International Development (USAID) within the framework of the USAID Energy Sector Transparency Project, which is implemented by NGO DiXi Group.